Jibal Qutman EL

The Jibal Qutman Exploration Licences ("EL's") are located in the central southern region of the Arabian-Nubian Shield and cover an area of 270km2. The EL's overlie more than 30km of the prospective Nabitah-Tathlith Fault Zone, a 300km-long structure with over 40 gold occurrences and ancient gold mines.

KEFI completed a Pre-Feasibility Study (“PFS”) on the Jibal Qutman Project in 2014. The PFS demonstrated a profitable carbon-in-leach (“CIL”) operation with All-in Costs (including operating costs, capital expenditure and closure costs) under $1,000 per ounce.

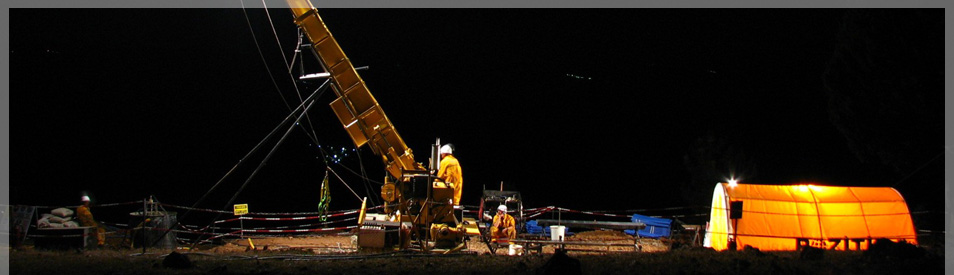

Following encouragement from the Saudi authorities, GMCO recommenced exploration and feasibility studies in 2022.

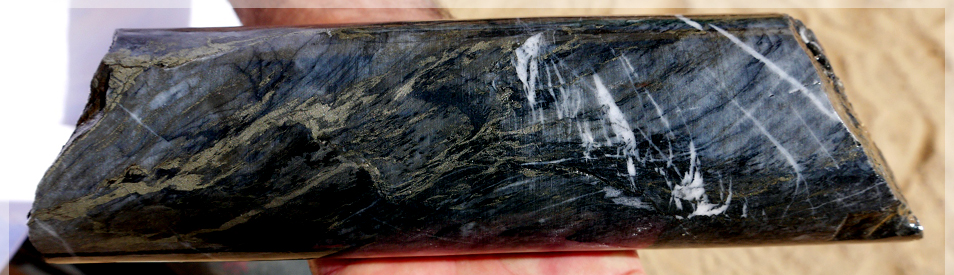

Drilling has identified gold resources in six areas - Main Zone, West Zone, South Zone, South Zone, 3K Hill Zone, 4K Hill Zone and Red Hill. Information on Jibal Qutman's geology and mineralogy is available in this conference poster.

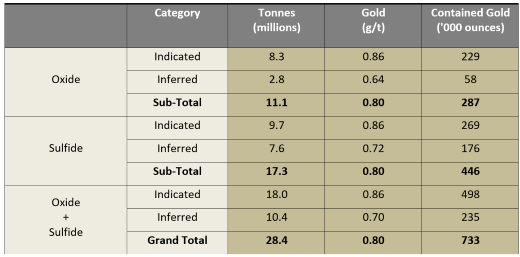

In May 2015, KEFI released an updated Mineral Resource estimate of 28.4 million tonnes at 0.80g/t gold, containing 733,045 ounces for Jibal Qutman. As summarised in the table below, the majority of the Mineral Resource is now in the Indicated category.

Jibal Qutman Mineral Resource Estimate (published May 2015)

The oxide gold mineralisation contained with the above Mineral Resource is estimated to total 11.1 million tonnes at 0.80g/t gold, containing 287,000 ounces. Drilling has already identified additional oxide gold mineralisation not in this resource estimate.

Given the established regional prospectivity for shallow oxide gold deposits, GMCO will undertake further exploration and drilling to expand the Jibal Qutman Mineral Resources.

- drilling for upgrading and expanding resources, geotechnical investigations and water supply;

- updated MRE following the conclusion of infill and expansion drilling;

- mine plan and Ore Reserves to be finalised following drilling results;

- processing flowsheet finalised;

- finance plan approved with SIDF; and

- commence procurement and site works.