Minesite.com

Kefi Is Endorsed By Centerra In Turkey

By Rob Davies

Exploration can be a lonely business. There are huge attractions in keeping full ownership of a property and proving the validity of your geological model. On the other hand it is helpful to get technical and scientific endorsement from other operators, especially when they have a proven track record and can bring in lots of cash. And today’s difficult economic environment makes those factors even more appealing. So the decision by Kefi Minerals to accept an offer from Centerra to become a joint venture partner on its promising Artvin property is easily understandable. Centerra’s two operating mines at Kumtor in the Kyrgyz Republic and Boroo in Mongolia produce over half a million ounces of gold a year and generate over US$10 million of cash a quarter at today’s prices. That allows it to spend US $25million a year on exploration.

The deal with Kefi commits Centerra to spending US$3 million over three years to earn a 50 per cent stake with the option to spend a further US$3 million to earn an additional 20 per cent. While that does dilute Kefi, it will also allow it to progress exploration at a much faster rate. The Artvin property lies in north-eastern Turkey, where the 15 tenements cover 254 square kilometres. Jeff Rayner, managing director of Kefi, says the small size of the tenements released by the government does make life difficult for explorers. That problem is compounded by the absence of any minimum expenditure requirements so tenements can remain locked away by inactive owners for a long time. On top of that there is no requirement for explorers to lodge data with the authorities so records of previous work are not readily available. The area around Artvin was explored by Rio Tinto many years ago, when the major was looking for porphyry copper, but Jeff says calls to the multinational miner for access to that data have not been returned.

The advantage that Kefi does have in Turkey is the database built up by Nuigini Mining. Jeff says that this gives Kefi as much data as would have been built-up over several decades. In practice what it means is that Kefi is able to make a very rapid assessment of any tenements that are released, and is then able quickly to bid for any that are of interest. It is clear that this database is a major attraction to Centerra, and is a principal reason why it’s using Kefi as its vehicle to expand into Turkey. While Centerra’s existing mine at Kumtor is profitable it seems that the political operating environment for western mining companies in the Kyrgyz Republic is gradually becoming more difficult. Turkey is an excellent country for such a company to turn its eyes to, as it is geologically prospective and welcomes investment in mining, although not all companies have had an easy time.

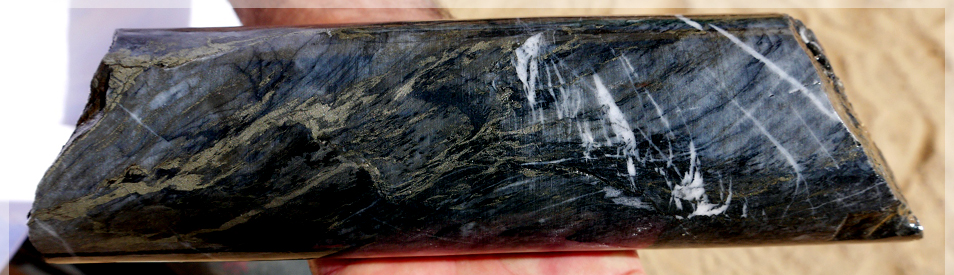

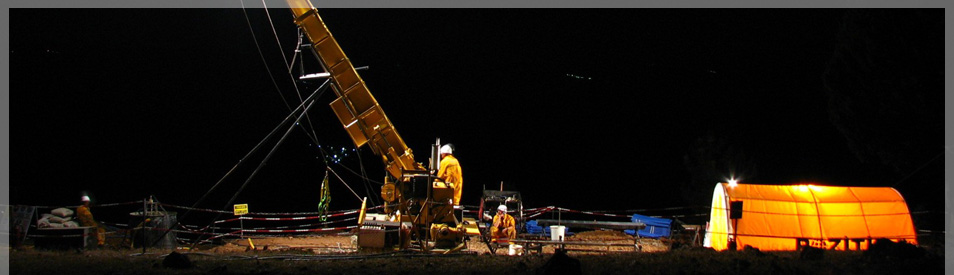

Artvin, with its 1.7 kilometre long copper and gold soil anomaly, is viewed as a potential porphyry copper or a massive sulphide target. There are not enough outcrops for channel sampling but an IP survey has detected a large sulphide anomaly in what is a complex geological environment. Jeff hopes to get two diamond drill holes away before the snow comes. This deal focuses attention on Artvin but Jeff also talks optimistically of Bakir Tepi, a name which means “copper hill” in Turkish, in the north east of the country. With two deposits nearby Jeff thinks it too could be part of a VMS (volcanogenic massive sulphide) belt. Another property that will receive more attention is Yatik in central Turkey. But in all these Jeff is reluctant to say too much for fear of attracting attention from other explorers. That might be good exploration practice, but it doesn’t help news flow to investors.