Saudi Arabia

.png)

The KEFI Gold and Copper team has been evaluating potential joint ventures and prospects in the Kingdom of Saudi Arabia since mid-2008.

As a 30% shareholder and manager of Gold and Minerals Limited (“GMCO”), KEFI has established a strong foothold from which to build on the momentum achieved to date.

KEFI is well placed to advance and develop our projects with the assistance of our partner Abdul Rahman Saad Al Rashid and Sons Company Limited (“ARTAR”), a leading local industrial group owned by Sheikh Al Rashid and his family. ARTAR is fully supportive of our progress in Saudi Arabia is and plays a vital role in our dealings with the Saudi Ministry of Industry and Mineral Resources and other important government organisations.

The Kingdom of Saudi Arabia has instituted policies to encourage minerals exploration and development. A resurgence of the Kingdom’s minerals sector could generate significant employment and assist with development of infrastructure in remote areas of the country.

GMCO is aligned with these policies with ARTAR as the majority shareholder and KEFI as the technical partner.

GMCO Prospects

GMCO is rapidly becoming a leading explorer/developer/producer in the fast-emerging Saudi minerals sector with:

- one of the largest exploration teams in the country; and

- two major projects advancing towards development - Jibal Qutman and Hawiah.

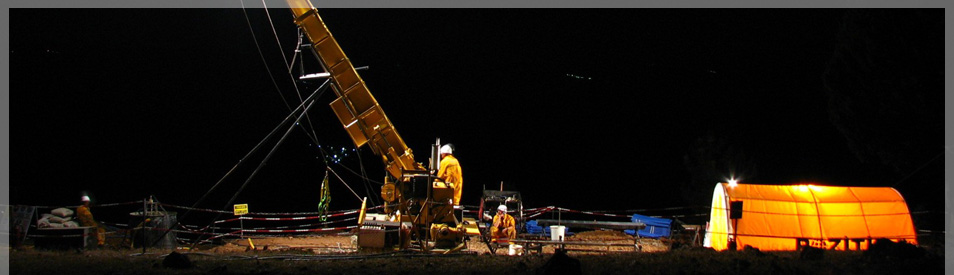

Following the grant of the Jibal Qutman EL in 2012, GMCO rapidly identified Mineral Resources totalling more than 700,000 ounces of gold by 2015. Following encouragement from the Saudi authorities, GMCO recommenced exploration and feasibility studies in 2022 and now holds three EL's covering 270km2 at Jibal Qutman.

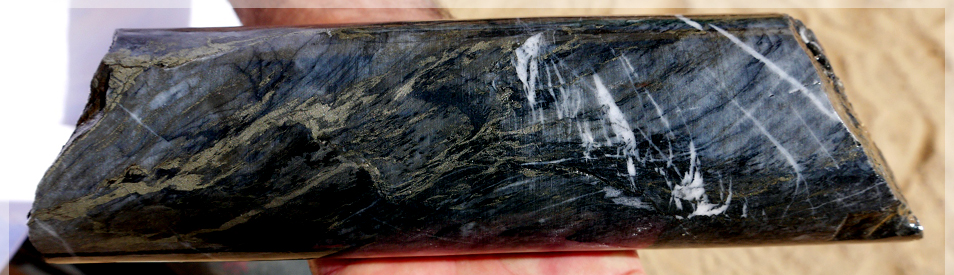

Drilling commenced at Hawiah in September 2019 and quickly delineated a VMS copper-gold-zinc deposit. Extensive drilling has defined a Mineral Resource of 29.0 million tonnes at 0.89% copper, 0.94% zinc, 0.67g/t gold and 10.1g/t silver, containing 258,000 tonnes of copper, 272,000 tonnes of zinc, 620,000 ounces of gold and 9.4 million ounces of silver.

GMCO also has a large portfolio of EL's in Saudi Arabia’s under-explored Precambrian Shield that are prospective for both gold and copper-gold mineralisation.

About ARTAR

ARTAR is a Saudi Arabian conglomerate investing in different sectors such as construction, real-estate, agriculture and health care in the Kingdom of Saudi Arabia and abroad. ARTAR’s principal business activities include commercial and residential property development, engineering, and construction of large shopping malls, hotels, hospitals and high rise apartment complexes.

Investment in the fledgling minerals sector in Saudi Arabia is part of ARTAR’s business expansion plans. For further information on ARTAR, visit the ARTAR website.