Minesite.com

Kefi Minerals Begins To Get A Grip On The Bureaucratic Machine In Saudi Arabia

By Alastair Ford

27 th May 2010

Jeff Rayner gets straight to the nub of the matter when Minesite rings him up for a chat in the wake of the Kefi Minerals AGM on 25th May. “We’ve appointed a consultant in Saudi”, he says. “A former director of geology in the Mines Ministry”. When the history of Kefi comes to be written, that move will be seen as a key step. Progress had hitherto been painfully slow. It should speed up now.

In the short period of time that it’s been open for mining-related business, Saudi Arabia has become notorious for the opacity of its bureaucratic process. Indeed, cynics on Saudi argue that there isn’t really a process at all, but rather just one great big roadblock. Jeff acknowledges that it’s not been easy, but argues that having a man who’s been right at the heart of that process should make an immeasurable difference.

Indeed, there are some signs that it already is. Partly, it’s simply a problem of logistics. Even in the desert, where Kefi is hoping to operate, the mining legislation requires that the mines department also has the approval of the archaeological, urban, and agricultural departments of government before it can give permission to a mining company to get to work. Organising all these people to be in one place at one time isn’t easy, says Jeff, as officials from the respective departments all have to visit the prospective ground itself. Fair enough, and very thorough, provided it gets done. To date, it hasn’t.

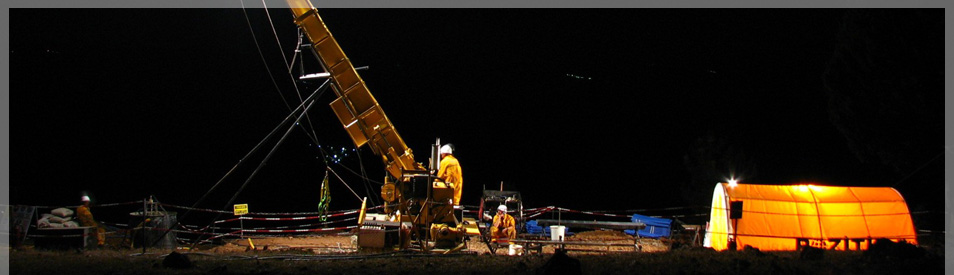

But with the new man on board, Jeff is optimistic that Kefi should be granted some of the licenses that it has applied for fairly soon. He’s now satisfied, he says, that the company can track the progress of the licenses through the bureaucratic machine, and with that visibility comes a renewed confidence. To add to the momentum, the Australian gold-copper company Citadel Resources has just been awarded a mining license in the country, a development which should make the naysayers sit up and take note.

As Jeff points out, despite the negative reputation that Saudi has managed to build for itself, Citadel hasn’t actually done badly. “There was a lot of apprehension about the delays they were receiving”, he says, “but they’ve only been in Saudi three years as Citadel and now they’re well on their way”. More to the point, Jeff continues, the granting of Citadel’s license gives Kefi hope that once it gets its own licenses it’ll be able to drill them out and progress to a feasibility study.

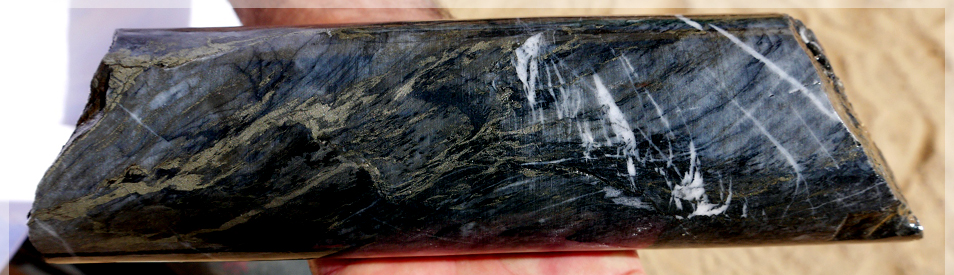

“It’ll be well worth the reward”, he adds. “Some of our prospects have got ready-made drill targets. There’s potential for us to prove up a string of heap leach prospects, or mines, as well as volcanic massive sulphide targets”. It’s big game country, but then the geological address is beginning to become known for the delivery of some fairly sizeable resources. Over the sea, but on the same Arabian Nubian Shield, Nevsun and Chalice are working on multi-million ounce discoveries in Eritrea. On Kefi’s own targets, historic data gathered by the French government 30 years ago clearly shows the potential, although Jeff’s not able to give details until the licenses are actually officially Kefi’s.

Having to be that circumspect must be frustrating, but Jeff counsels just a little bit more patience. For one thing, having a former director of geology in the Mines Ministry on board may start to pay real dividends, and he’s not yet long been in the post. Perhaps more importantly, reckons Jeff, there’s a real danger that companies might withdraw if they continue to draw a bureaucratic blank. After all, why bother? John Teeling’s just re-focussed Persian Gold away from Iran, because of bureaucratic inactivity, and there’s no reason why companies in Saudi won’t do likewise. “I think there’s a fair bit of pressure now on the government”, says Jeff. After all, he adds, it’s just an exploration license, just chip sampling and drilling. “It’s not exactly big environmental works.”

If the Saudi gambit does come off, then you can sense that the excitement inside Kefi will start to build up rapidly. But if it doesn’t, then there’s always Turkey to fall back on. Here the company has been having a mixed time of it, as one prospect, Bakir Tepe, failed to live up to expectations, while another, Artvin, could yet turn out to be a useful-looking porphyry copper-gold find. Kefi’s joint venture partner in Turkey, Centerra, seems willing enough for now to roll with the punches, and indeed is actively engaged with Kefi in a quest to pick up more ground in the east of the country. One way or another, the second half of the year should be an interesting time for Kefi.