Saudi Arabia

As part of a broader strategy to diversify the country’s revenues away from oil, Saudi Arabia is looking to expand and develop its mineral sector.

Key commercial advantages for KEFI in Saudi Arabia are:

- A country under-explored for minerals with only a few companies exploring for gold and copper;

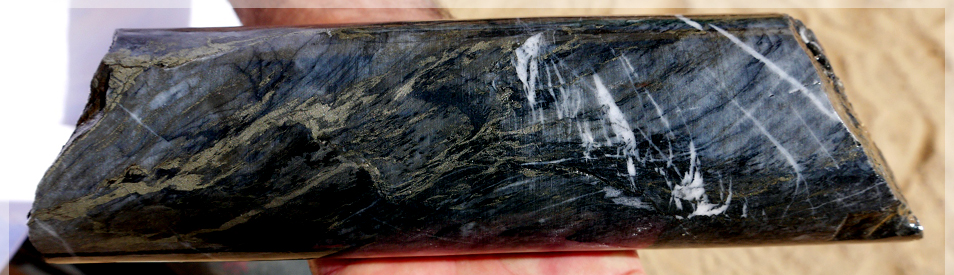

- The Precambrian Arabian-Nubian Shield rocks are very prospective for gold and copper;

- Exploration, development and operating costs are low by industry standards, benefitting from low energy and labour costs;

- Saudi Industrial Development Fund provides loans for up to 75% of the capital cost of mine development at nominal interest rates;

- A modern mining code; and

- A strong local joint venture relationship.

Mining History

Saudi Arabia has been a historic producer of gold with gold mining extending back over 5,000 years. The Mahd Adh Dhahab (Cradle of Gold) mine has been estimated to have produced over six million ounces of gold since antiquity. It is reputed to be the fabled King Solomon’s Mine and is still in production today with remaining resources of more than 1 million ounces of gold.

The Saudi Arabian Directorate General of Mineral Resources (DGMR) commenced gold exploration in the 1970s, following a rise in value of the metal. The United States Geological Survey (USGS) and French equivalent, Bureau de Recherches Géologiques et Miniéres (BRGM), were commissioned to document and evaluate the mineral occurrences over a 25 year period from the 1970s to mid-1990s. Over 5,000 historic mines and occurrences were discovered.

Some larger international companies, such as Noranda, Boliden, Utah, Rio Tinto and Petromin (now called Ma’aden) explored Saudi Arabia for gold and base metals in the late 1970s to early 1990s. Since 2000, Ma’aden has discovered JORC-compliant resources totalling approximately eight million ounces of gold in the Central Arabian Gold Region. Relatively little modern exploration has been undertaken in the large Precambrian Shield of Saudi Arabia, which measures approximately 1,500km north-south and 800km east-west, and there remains substantial potential for further discoveries of significant gold and copper deposits.