Jibal Qutman EL

The Jibal Qutman Exploration Licences ("ELs") are located in the central southern region of the Arabian-Nubian Shield and cover an area of 270km2. The ELs overlie more than 30km of the prospective Nabitah-Tathlith Fault Zone, a 300km-long structure with over 40 gold occurrences and ancient gold mines.

KEFI completed a Pre-Feasibility Study (“PFS”) on the Jibal Qutman Project in 2014. The PFS demonstrated a profitable carbon-in-leach (“CIL”) operation with All-in Costs (including operating costs, capital expenditure and closure costs) under $1,000 per ounce.

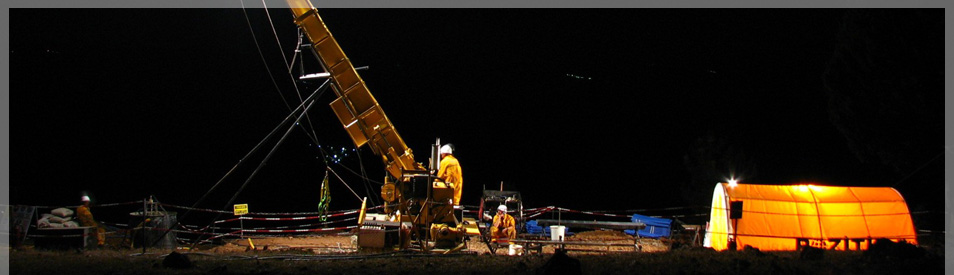

Following encouragement from the Saudi authorities, GMCO recommenced exploration and feasibility studies in 2022.

Drilling has identified gold resources in seven zones - 4K Hill, Pyrite Hill, 3K Hill, Main and West, Red Hill and South Combined. All zones dip moderately to steeply (~35° to 80°) towards the east, except the Pyrite Hill Zone which dips to the west.

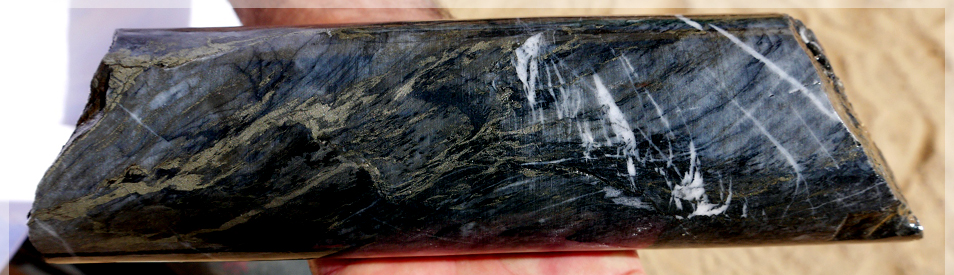

Gold mineralisation extends for approximately 7km along strike, concentrated in seven discrete zones which outcrop at surface. Near-surface mineralisation occurs intermittently over 500m at the widest zone, comprising a closely stacked series of discrete mineralised zones varying in width from metre-scale to 15m and extending to a depth of approximately 150m below surface. Information on Jibal Qutman's geology and mineralogy is available in this conference poster.

In February 2025, KEFI published an updated Jibal Qutman MRE of 37.0Mt at 0.76g/t gold, containing 902,000 ounces of gold, including 30.5Mt at 0.76g/t of gold, containing 748,000 ounces in the Indicated category (83% of total MRE). Oxide Resources now total 13.2Mt at 0.75g/t gold, containing 318,000 ounces.

The three zones providing the most ounces are Main and West (292,000 ounces), South Combined (243,000 ounces) and Red Hill (183,000 ounces). Further information on the 2025 Jibal Qutman MRE is detailed in KEFI’s announcement “Material Upgrade to Jibal Qutman Gold Project Mineral Resources” dated 26 February 2025.

Jibal Qutman’s 2025 MRE provides the basis for a long-life mine as substantial Ore Reserves are likely to flow from the 83% (30.5Mt) of the MRE now in the Indicated category.

With a strong gold price and with low-cost, local development capital, fast tracking an (initially) oxides-focused open-pit, CIL operation at Jibal Qutman is becoming very attractive.