Minesite.com - Drilling In Saudi Arabia Begins To Deliver Significant Results

Shares in Kefi Minerals Surge As Drilling In Saudi Arabia Begins To Deliver Significant Results

15 Nov 2012 by Sally White

Jeff Rayner, the managing director of Kefi Minerals has lately been telling investors that his company’s progress in Saudi Arabia has been “excellent”.

The response in the Kefi share price shows that they agree. After protracted delays in getting the requisite permits Kefi has now commenced drilling, and in response the shares touched a 12 month high of 4.9p in late October.

Three weeks on and the shares are now slightly weaker at 4.075p, but that’s still higher than they’ve traded all year, barring the October spike.

But then, opportunities have been opening up rapidly over this year as Kefi has also been able to take the number of its exploration licences up to four, the latest coming in July.

How is the company able to show such progress when Saudi Arabia is widely known to be a tricky jurisdiction?

Simple. Kefi works in Saudi through a 40/60 joint venture with a highly respected and substantial local construction, real estate development and investment company, Abdul Rahman Saad Al-Rashid & Sons (ARTAR).

With that sort of support behind it, Kefi is very hopeful that more of the 19 exploration licence applications it has applied for will be granted. It expects to be able to announce some good news any time now.

But in the meantime, Kefi has lost no time in cracking on with work programmes on the ground it already has.

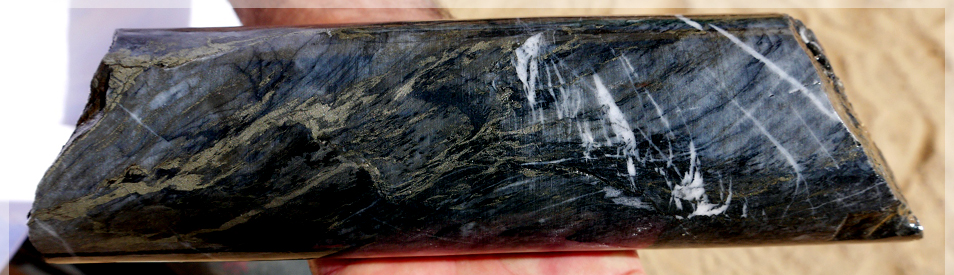

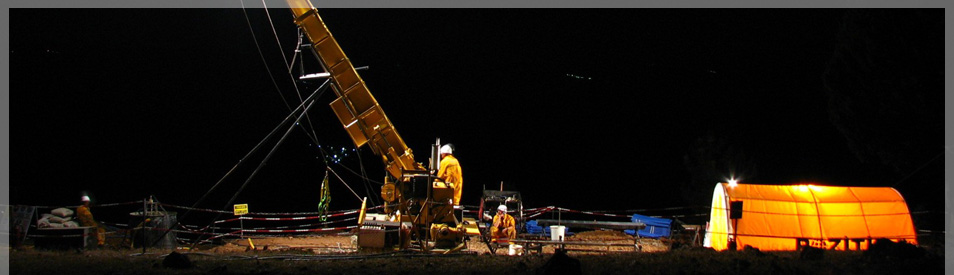

Particularly exciting results have come in from the Selib North project, where an exploration licence was granted in June last year. Diamond drilling commenced this July on recently discovered gold-bearing dykes.

And results from eight holes drilled down to 100 metres appear to confirm Kefi’s view that gold is hosted in a series of steeply-dipping pyritic dykes. What’s more, says Jeff, “the dykes may potentially converge to a larger parent rock at depth”.

He is extremely excited by these results, and it’s easy to see why. The best drill intercept so far runs at 11 metres grading 3.11 grams per tonne.

But it’s not just the grade. “To our knowledge”, he says, “this style of gold mineralisation has not been documented in the Arabian shield before and could be potentially part of a larger intrusive system.” The discovery has the potential for bulk tonnage gold deposits.

Kefi has now started on a follow-up induced polarisation survey to define drill targets at depths below the current level, and further to the north.

Encouraging results have also been obtained at a second project at Jibal Qutman. Here earlier rock chip sampling results from the on-going trenching programme confirmed the presence of high grade gold and silver in massive quartz veins, which generally run at between two to five metres in thickness.

Together with the footwall and hanging-wall stockworks, the mineralised zones range up to 23 metres in width. And subsequent drilling the results of which were released early in November, give further grounds for encouragement.

Among the better intercepts were 7.1 metres at 5.85 grams per tonne and seven metres at 4.29 grams per tonne.

“These promising results from our initial work at the Jibal Qutman Licence confirm the presence of high grade gold and silver over substantial widths and strike lengths,” Jeff says.

Meanwhile, over at Hikyrin South samples taken from ancient waste dumps have returned grades of up to 16.3 grams per tonne of gold. The average grade across all the samples was 5.9 grams per tonne. A drilling programme is scheduled.

All this work costs money of course, but there is still plenty of cash still in the bank after an oversubscribed share issue in February and a further issue in August, which raised a total of £2,861,000.

So the immediate aspiration to complete 12,000 metres of drilling seems well within reach.

There is plenty of anticipation as to what the results of such drilling will show. In London, both Fox Davies and SP Angels are fans. And it’s not hard to see why. “The results so far further highlight the huge prospectivity of the region and the potential to add value for the long term benefit of all stakeholders”, says Jeff.

But what really sets Kefi apart is the backing of ARTAR. As if to underline the point, the Al Rashid family put up all the money for the second share issue, for £966,000.

The strength of this level of financial support is backed by equally important help in the form of all local negotiation. So, there will be no problems about going for more rigs or in keeping up Kefi’s momentum on licences.